In an era where software companies are aggressively marketing their AI-driven bookkeeping solutions as the end-all for small business financial management, there’s an important question to answer: Will anyone need a bookkeeper in the future? It’s not a simple question to answer. It’s true that AI has revolutionised bookkeeping (for those who have adopted it) by automating repetitive tasks, but the human element – in particular, the interpretation of data and strategic insight – remains irreplaceable, let me tell you why.

The limitations of AI in bookkeeping

We’ve all seen the ads. “Buy this software and you’ll never need a bookkeeper again”. It’s true that AI-driven bookkeeping tools are incredibly efficient at processing invoices, managing data entry, and even conducting some levels of financial analysis. They promise a world where small business owners are freed from day-to-day financial record-keeping, offering more time to focus on growing their business. However, this is only part of the picture.

AI, for all its advancements, cannot understand context, make nuanced judgments, or anticipate future trends based on current economic or market conditions. It operates within the confines of its programming, and it simply can’t replicate the depth of insight a human bookkeeper brings to the table.

The indispensable role of human bookkeepers

Human bookkeepers do much more than just keep records; they interpret data, provide strategic advice, and help steer the business towards its financial goals. They look beyond the numbers to understand what they mean in the broader context of your business and the market at large. This level of analysis and insight is something AI, at least in its current state, cannot offer.

As a human bookkeeper myself, I can tailor my advice to suit the unique needs and nuances of your business. I build relationships with my clients, understand their challenges and opportunities, and provide personalised advice to help you make informed decisions. With so much of the bookkeeping more automated, I can give this kind of crucial advice more time, meaning you get so much more value from your bookkeeper in 2024 than you did 10 years ago.

Bridging Technology with Strategy

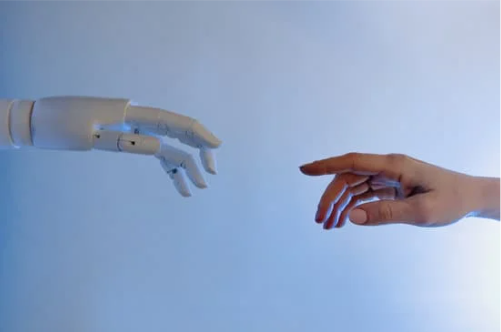

The ideal approach to modern bookkeeping combines the best of both worlds: leveraging AI’s efficiency and accuracy for routine tasks while relying on human expertise for strategic financial planning and decision-making. This hybrid model ensures that while the day-to-day bookkeeping tasks are efficiently managed, the strategic financial guidance necessary for business growth and adaptation is not overlooked.

Conclusion

So, do you need a bookkeeper if AI can do your bookkeeping? The answer is a resounding yes. AI bookkeeping tools are incredible for their efficiency and accuracy, but they cannot replace the strategic insight, personalised advice, and nuanced understanding that a human bookkeeper brings. I see it as a collaboration between human expertise and AI efficiency.

The narrative pushed by some software companies, that AI can handle all aspects of bookkeeping, oversimplifies the reality of financial management. While AI transforms the mechanics of bookkeeping, the strategic soul of the profession will remain human – just like AI won’t remove you from your business. The future looks exciting and I’d love to support you in yours.

To find out how I can support you, call us today on 01823 793410